Why DIY Financial Planning Breaks Down When It Matters Most

Most golfers look great on the driving range.

That’s not where rounds are lost.

Money works the same way.

This post examines why DIY financial planning feels efficient in calm conditions — and why data shows it consistently breaks down when pressure, volatility, or disruption shows up.

Recently, our home was lost to a fire.

What mattered immediately wasn’t optimization or projections — it was access, sequencing, and knowing which decisions could safely wait.

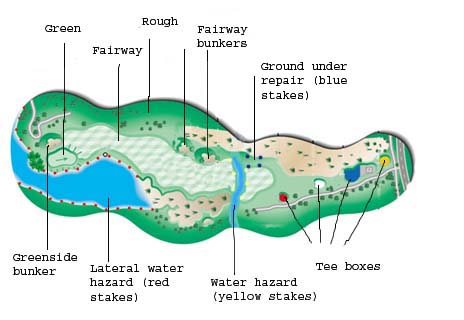

It felt less like casual planning and more like standing on an unfamiliar tee with hazards you can’t fully see yet.

That’s when structure matters.

Business owners who DIY their planning often assume:

“I understand my numbers better than anyone.”

“I’m disciplined — I’ve built a business.”

“I’ll make rational decisions when something changes.”

“Advice is optional; planning is not.”

None of these assumptions are careless.

They’re just rarely pressure-tested.

Behaviour Beats Knowledge (In the Wrong Direction)

Over 30+ years, self-directed investors have underperformed simple market benchmarks by ~3–4% per year, driven largely by timing and behavioural decisions rather than poor investment selection (DALBAR).

A 3% annual behaviour gap over 25 years can reduce final wealth by 40–50%, even if market returns are identical.

That’s not bad intelligence.

It’s choosing the wrong club when conditions change.

Cognitive performance declines by 30–40% under acute stress.

Following major life disruptions (job loss, illness, property loss), households are 2–3× more likely to make irreversible financial decisions within the first 90 days.

A majority of those decisions are later identified as regret-driven.

Stress doesn’t make people reckless.

It narrows focus — often away from the real risks.

Roughly 70% of business owners’ net worth is tied to their company.

Fewer than 30% have a clearly documented personal liquidity strategy outside the business.

More than 60% of business exits occur due to unplanned events — health issues, burnout, or partnership breakdown — not strategic timing.

Most DIY plans assume continuity.

Reality often interrupts it.

About 40% of Canadian households are underinsured relative to income-replacement needs.

For business owners, disability is statistically a higher-probability financial derailment than premature death before age 60.

Yet disability coverage remains one of the least reviewed elements in DIY plans.

These gaps don’t show up in spreadsheets.

They show up in cash flow.

DIY financial planning doesn’t usually fail because of bad math.

It fails because the same person is designing the plan, interpreting risk, and making decisions under pressure.

In golf, that’s when course management matters more than swing mechanics.

With money, it’s no different.

Pressure test your plan:

If income stopped for 90 days, where would you be forced into rushed decisions?

Which assumptions rely on markets, health, or energy staying “normal”?

Where would you wish you’d slowed down before acting?

If the answers aren’t clear, that’s not failure.

It’s useful information.

Most people only run this test after the first thing breaks.

This is the kind of thing worth reviewing before circumstances force the review.

Most financial damage doesn’t come from dramatic mistakes.

It comes from small, reasonable decisions made under strain.

Good structure doesn’t eliminate risk.

It keeps big numbers off the card.